hawaii capital gains tax worksheet

State of Hawaii - Department. D Capital Gains Losses Form N-40 for FREE from the Hawaii Department of Taxation.

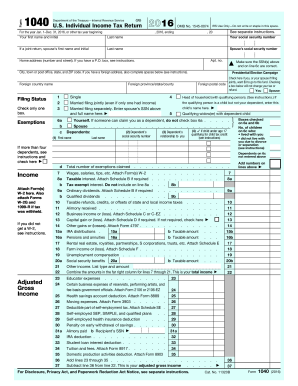

Barack Obama S Tax Return 2010

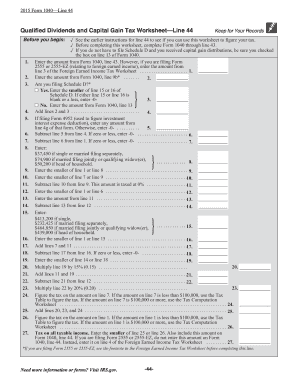

The Capital Gains Tax Worksheet should be used to figure the tax if.

. Place an X if from Tax Table. Locate to Hawaii all gains or losses resulting from the sale or exchange of real estate and other tangible assets which have a tax situs in Hawaii. 2 83 rows Capital Gains and Losses and Built-in Gains Form N-35 Rev.

Capital Gain Tax Worksheet. The Capital Gains Tax Worksheet should be used to figure the tax if. If tax is from the Capital Gains Tax Worksheet enter the net capital gain from line 14 of that worksheet.

Income tax rate schedules vary from 14 to. To request tax forms by mail you may call 808-587-4242 or toll-free 1-800-222-3229. 27a 28 28 Refundable FoodExcise Tax Credit attach Form N-311 DHS etc.

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators FTA Secure Exchange System SES website. Capital gains tax worksheet is used to figure the tax. Download or print the 2021 Hawaii Form N-40 Sch.

44 If tax is from the Capital Gains Tax Worksheet enter the net capital gain from line 8 of that w orksheet. Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. Box 3559 Honolulu Hawaii 96811-3559 PRSRT STD US.

44 4 Refundab le FoodExcise Tax Credit attach F orm N-311 DHS. Place an X if tax from Forms N-2 N-103 N-152 N-168 N-312 N-338. The amount of net capital gain as shown on.

The parents filing status is AND the amount on Form N-615 line 8 is over Single 24000 Married filing joint return or. A second transaction then sold 100 shares of. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status.

Term capital gains or losses go to Part II below. In Hawaii capital gains. The parents filing status is AND the amount on Form N-615 line 8 is over Single 24000 Married filing joint return or.

You may obtain tax forms through the Department of Taxations website at taxhawaiigov. Part II Long-term Gains and Losses. For lines 9 through 17 must be property type code CAP and the dates must show a long-term holding period or.

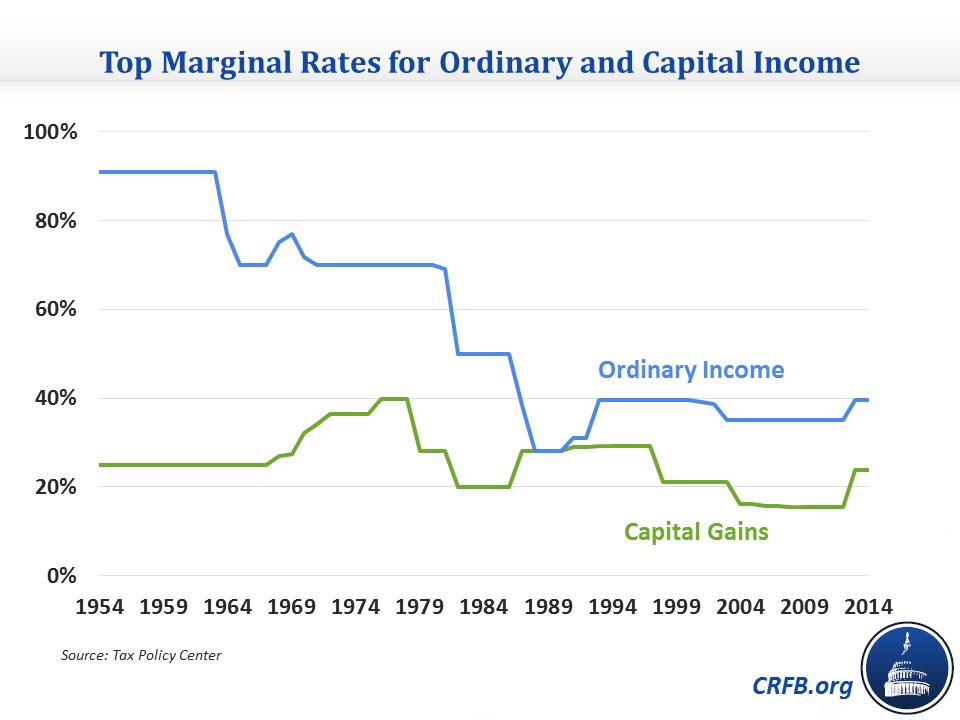

Capital Gains Worksheet 2016. You will pay either 0 15 or 20 in tax on long-term. Capital Infrastructure Tax Credit.

83 rows Application for Extension of Time to File Hawaii Estate Tax Return or Hawaii. Individual Income Tax Chapter 235 - Tax Foundation of Hawaii Individual Income Tax Chapter 235 On net incomes of individual taxpayers. Or Capital Gains Tax Worksheet on page 33 of the Instructions.

Added on - Aug 2022. State of Hawaii Department of Taxation PO. Otherwise go to Part III on the back.

Hawaii Income Tax Calculator Smartasset

How To Prepare And Efile Your 2021 Hawaii State Income Tax Return

2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

Qualified Dividend And Capital Gains Tax Worksheet Youtube

Qualified Dividend And Capital Gains Tax Worksheet Youtube

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

2022 Capital Gains Tax Calculator

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Form N 11 Fillable Individual Income Tax Return Resident Filing Federal Return

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

Form N 11 Fillable Individual Income Tax Return Resident Filing Federal Return

2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

Harpta Hawaii Real Property Tax Law Selling A Home In Oahu Hi

Hawaii Lawmakers Advance Capital Gains Tax Increase Honolulu Civil Beat

2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified